State of Mobile 2025: Key Data and Trends from Sensor Tower

Sensor Tower has published a new report, State of Mobile 2025, covering 10 industries and 23 markets. It provides insights into the mobile market, key trends, and user behavior.

The report is valuable for those who want to stay updated on the latest in mobile advertising and apps.

Key Findings from State of Mobile 2025:

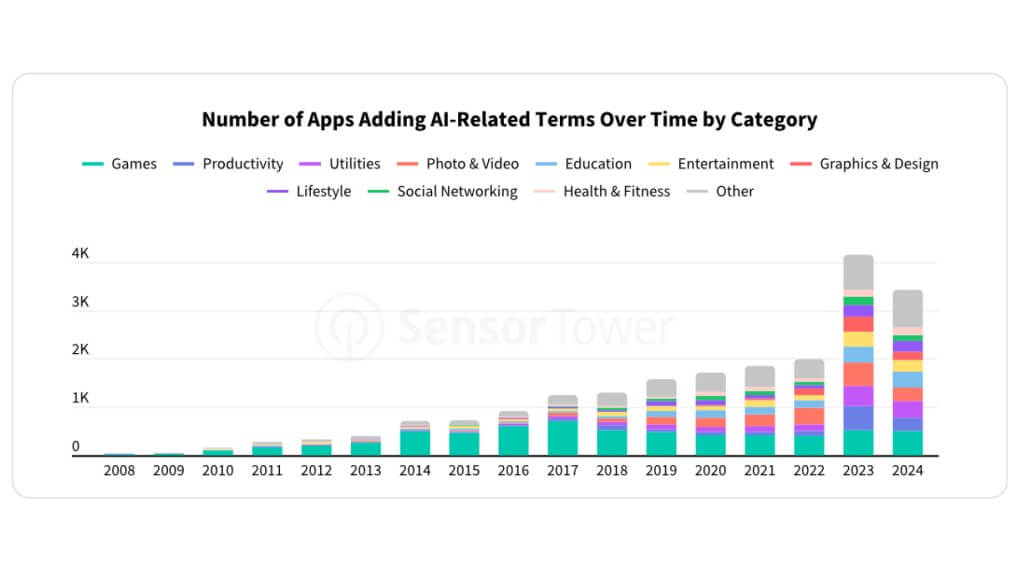

- AI is expanding across apps. Over two years, more than 100 apps in 15 categories added AI-related terms, with the most common in Productivity, Photo & Video, and Education categories.

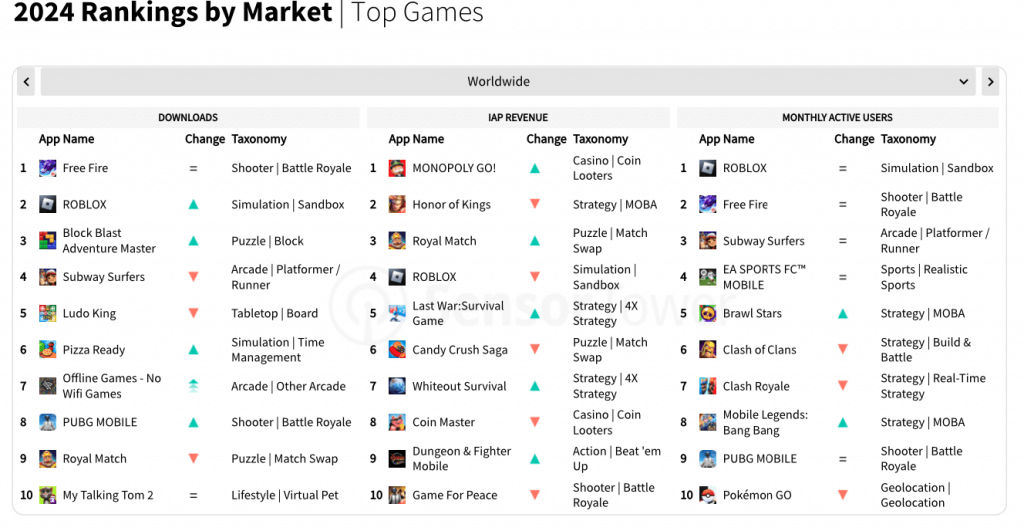

- Gaming habits remain unchanged. Users prefer proven games over new releases. Popular hits like Subway Surfers, Royal Match, and Candy Crush Saga continue to dominate.

- Demand for financial apps is growing. Economic recovery and rising Bitcoin prices have boosted demand for investment services and crypto apps.

- Fitness apps are on the rise. The Gyms & Fitness category shows a high level of user retention, with seven out of the ten most downloaded apps worldwide belonging to this segment.

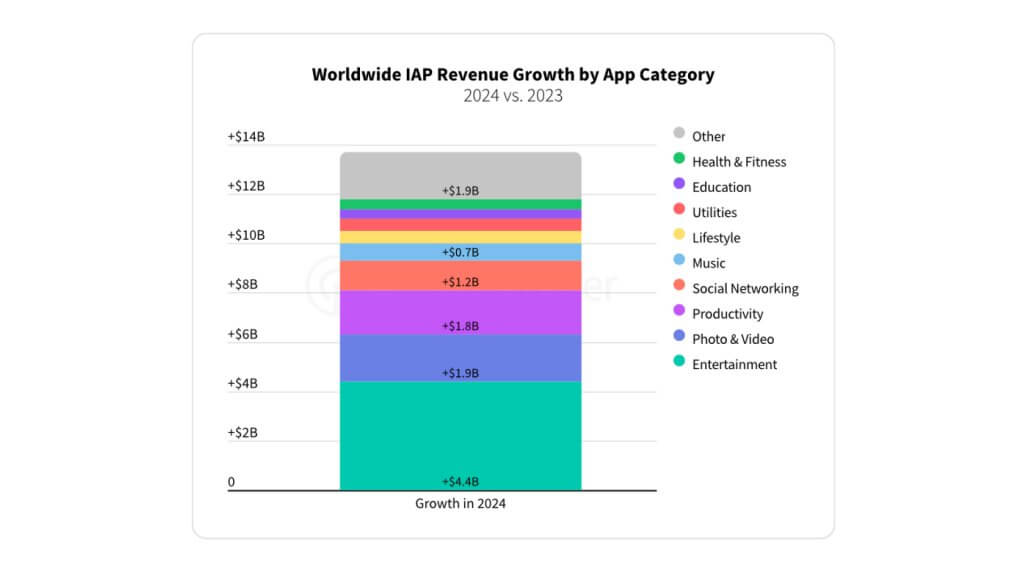

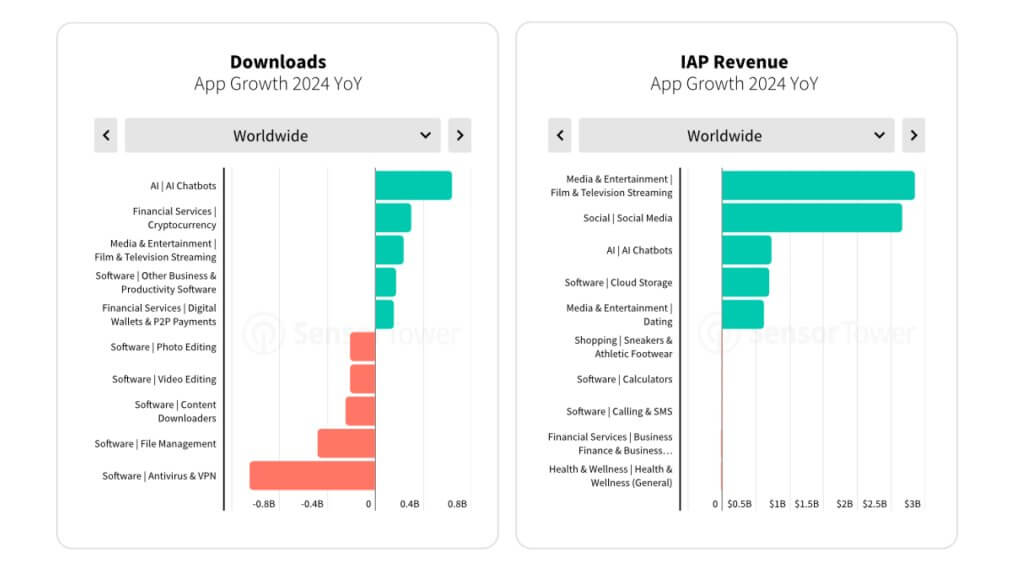

In-App Purchase Revenue Increased

In 2024, in-app purchase and subscription revenue grew by 13%, reaching $150 billion. North America and Europe were the leading regions.

Although game revenue continues to rise, its growth rate significantly lags behind other app categories.

For example, revenue from in-app purchases in non-gaming apps has been growing rapidly – over the past 10 years, it has increased from $3.5 billion to $69 billion.

The main contributors to this growth were apps in the Entertainment, Productivity, and Photo/Video categories.

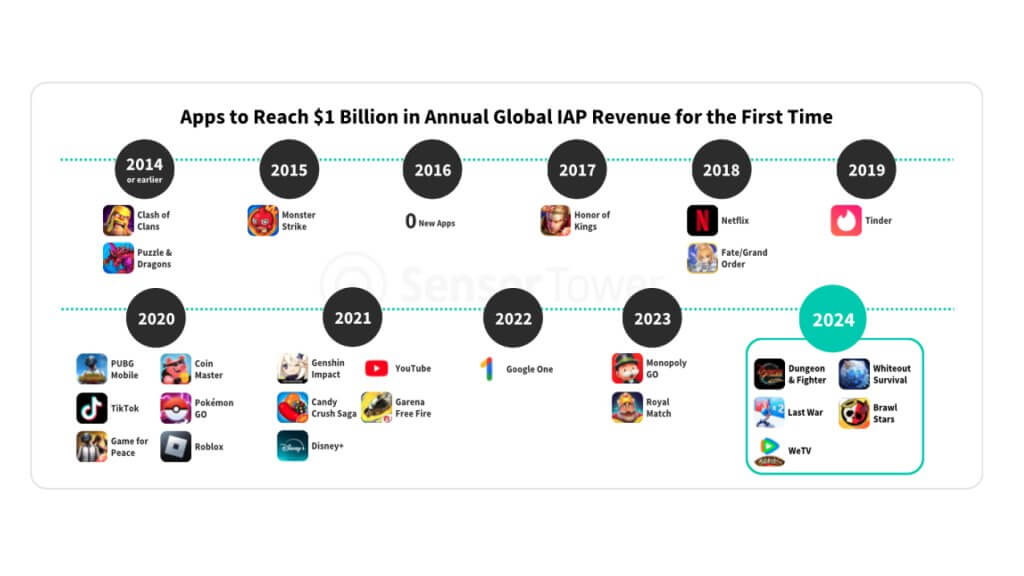

Four Games Reached $1 Billion in Revenue

In 2024, four games reached the $1 billion mark in in-app purchase revenue for the first time. These games are:

- Last War

- Whiteout Survival

- Dungeon & Fighter

- Brawl Stars

This record number of new entrants into the “billion-dollar club” since 2021 confirms the recovery of the mobile gaming market.

Among non-gaming apps, only one reached the $1 billion milestone in 2024 – WeTV.

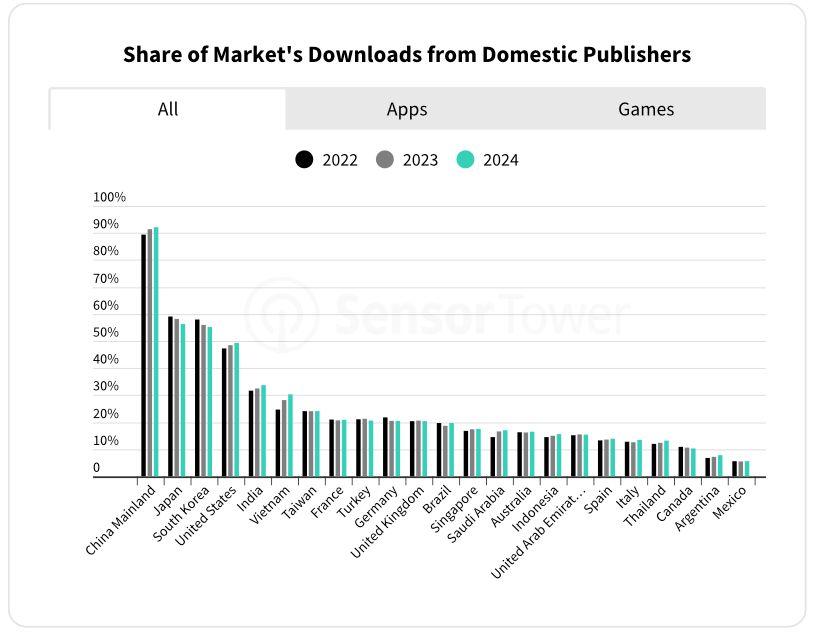

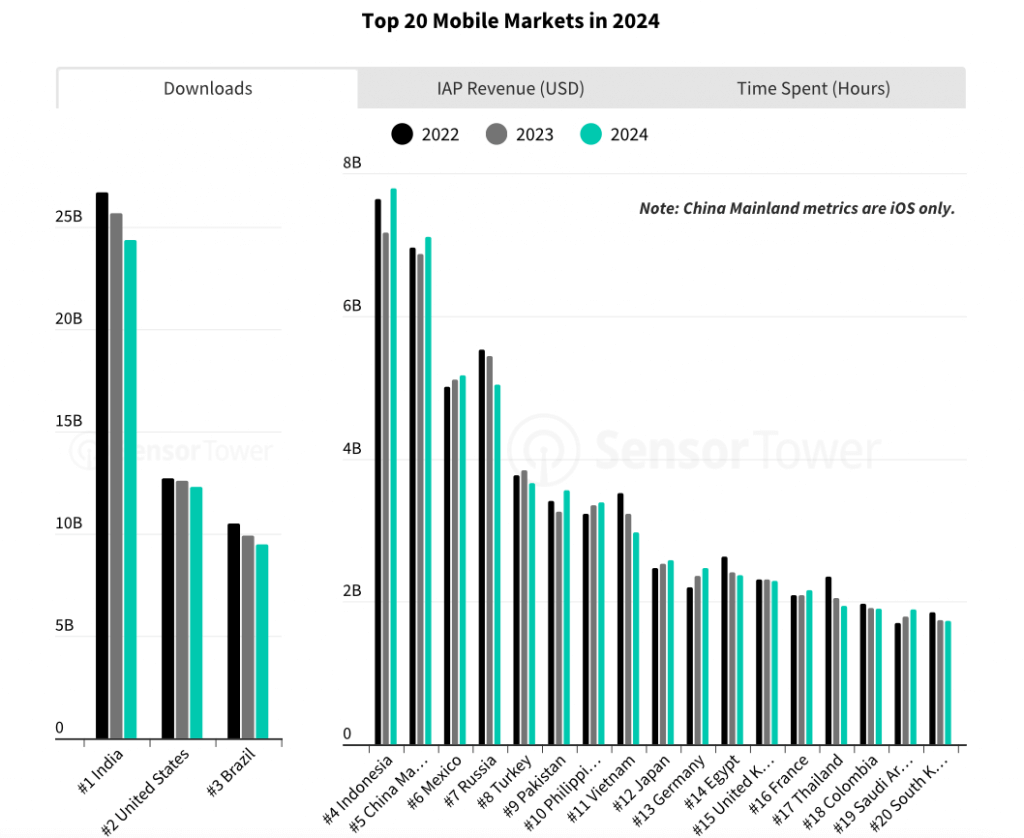

The Mobile Market Becomes Global

According to the State of Mobile 2025, about 80% of downloads and spending occur outside the countries where the apps were developed.

The share of local publishers varies significantly across markets. In China, more than 90% of downloads and user spending are attributed to apps from Chinese developers.

Japan, South Korea, and the United States also maintain a strong presence of local publishers.

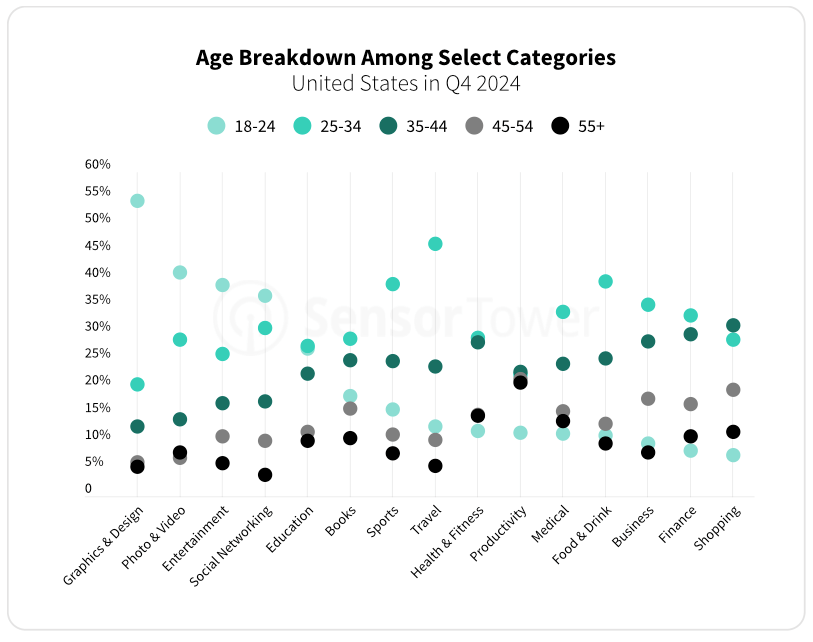

Popular Apps by Age Group

Young adults aged 18-24 typically choose apps from creative categories like Graphics/Design and Photo/Video. They are also active on entertainment platforms like Tik Tok, YouTube, ChatGPT, and CapCut.

Users aged 25-34 prefer apps in the Music, Messaging, and Social Networks categories (e.g., Spotify, Telegram, Discord, and Snapchat).

Middle-aged users (35-44) tend to favor apps for online shopping and financial planning (e.g., Amazon, Binance, Venmo).

Older users (45+) more often select apps for productivity tracking, health monitoring, and fitness (e.g., Home Workout, Step Counter – Pedometer, Mi Fitness).

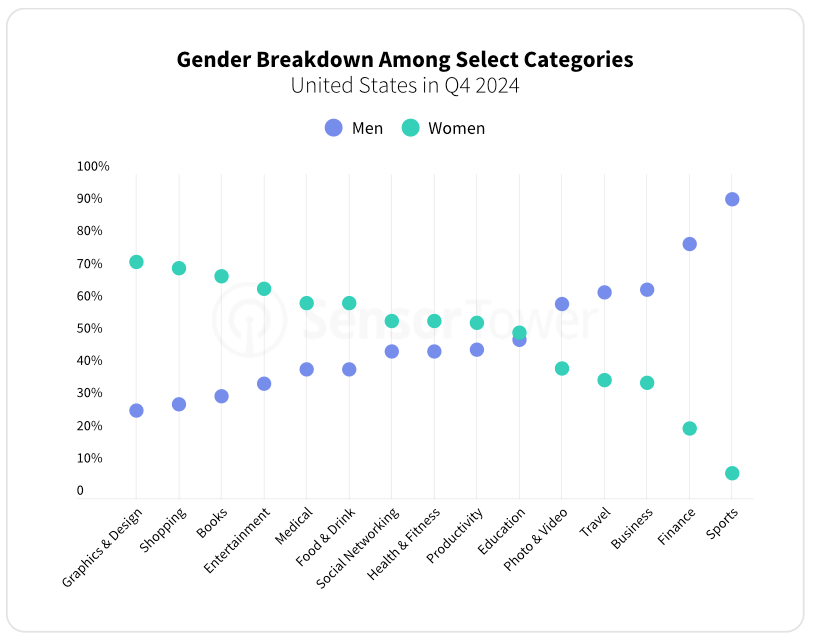

Popular Apps: Men vs Women Preferences

- Women are twice as likely to use apps from the Graphics & Design, Shopping, and Books categories.

- Men, on the other hand, tend to favor apps in the Sports, Finance, Travel, and Business categories.

While most popular apps are used by both genders, some show clear preferences.

For example, Discord and Reddit are more popular with men, while Pinterest and TikTok are favored by women.

Growth of AI Apps and Chatbots in 2024

AI is covering more and more apps. In 2024, over 3,000 services added AI-related terms to their names or descriptions for the first time.

The highest growth was recorded in the Productivity, Photo & Video, Finance, and Lifestyle categories.

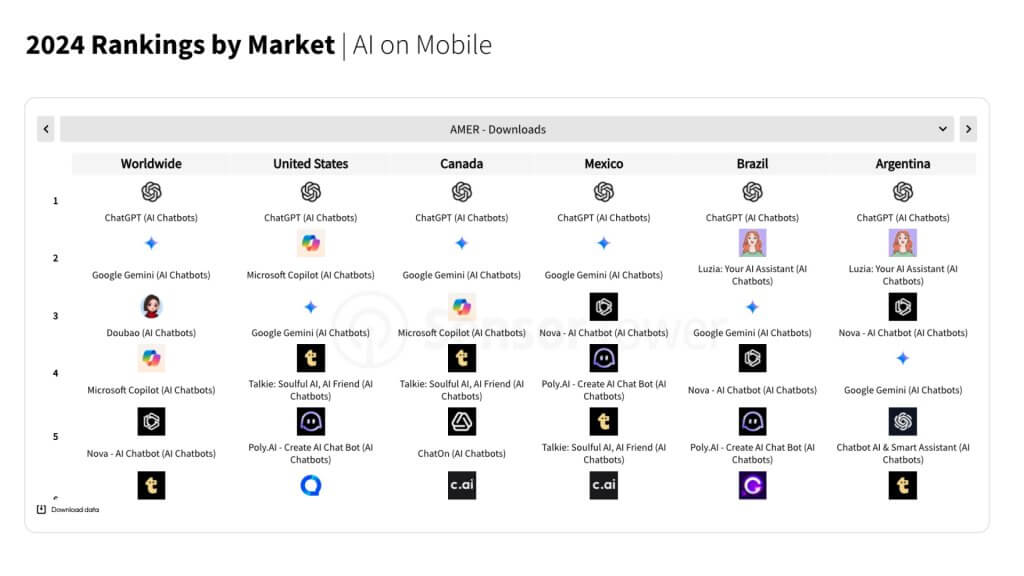

The popularity of AI apps is confirmed by the growth in downloads, which reached 17 billion over the year. The leading countries were India, the US, China, Indonesia, and Brazil.

The most popular app in the segment was ChatGPT:

- Reached 50 million MAU just 5 months after its launch in May 2023.

- MAU growth was 500% year-over-year, exceeding 160 million by Q3 2024.

Notably, the fastest-growing category was AI chatbots. They attracted 635 million new users and maintained a high retention rate.

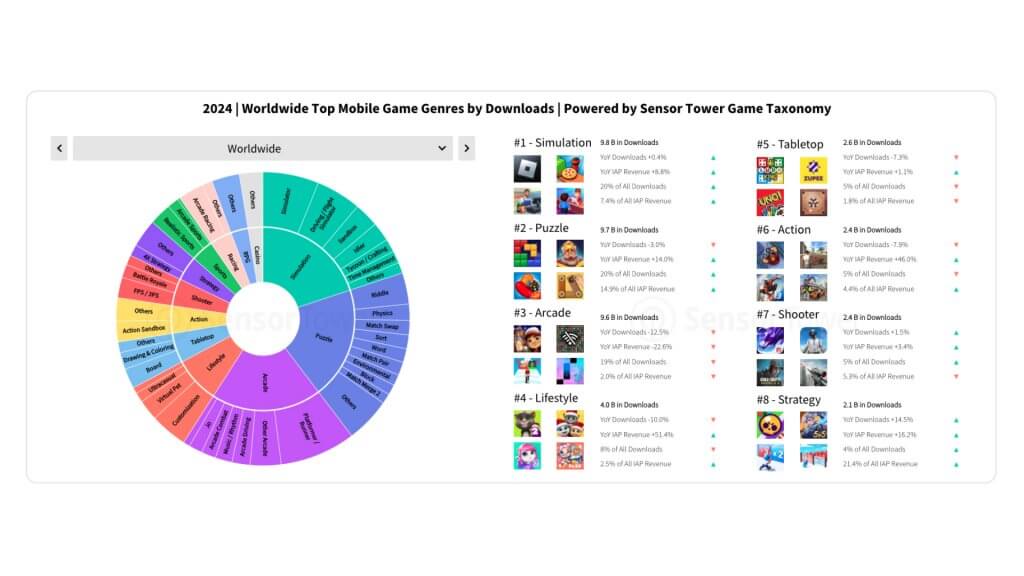

Popular Mobile Game Genres in 2024

In 2024, Simulation and Puzzle genres led mobile game downloads, each capturing 20% of the total downloads.

Arcade games, despite a significant 12.5% drop in downloads, maintained 19% of the market, confirming their enduring popularity.

Lifestyle and Action genres saw a steeper decline, while Strategy games experienced impressive growth at +14.5%.

Fewer New Games in the Top Rankings

Since 2020, the number of new mobile games in the top 1000 has decreased by more than half, from 200 to just over 100 in 2024.

However, the average number of downloads per game remains stable (1–2 million), indicating a shift in focus from quantity to quality. For example, hits like Roblox and Subway Surfers continue to maintain high download numbers.

Mid-core and hardcore genres continue to gain popularity. Among the leaders are:

- Shooters (e.g., Call of Duty: Warzone Mobile)

- MOBA games (e.g., Squad Busters).

There is also an increase in interest in strategy and lifestyle games.

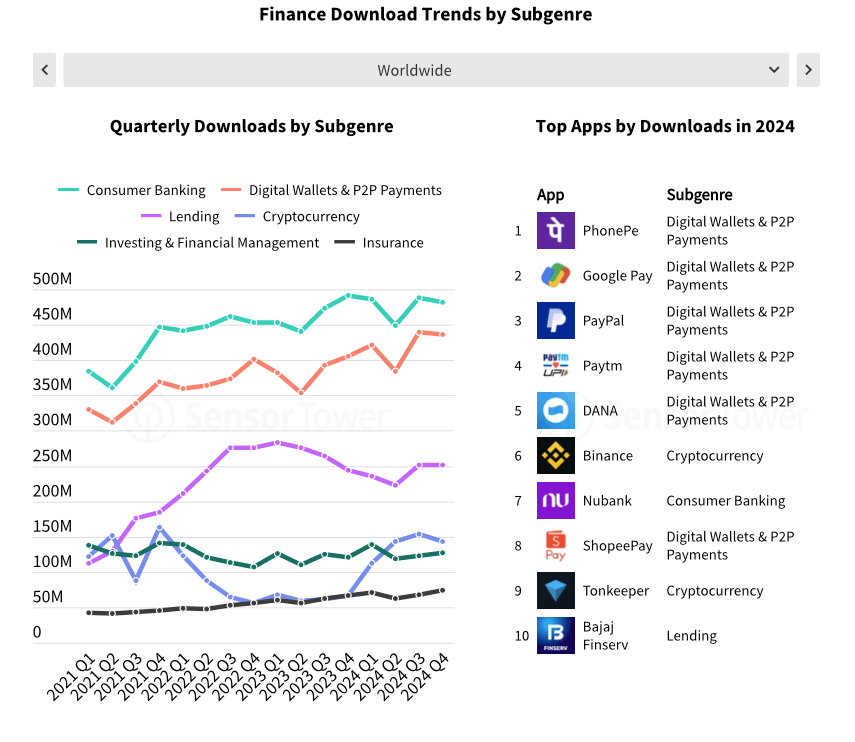

Popular Financial Apps in 2024

The total number of downloads for financial apps in 2024 exceeded 7 billion, marking an 8% increase.

The most in-demand segments were:

- Digital wallets and P2P payments (+10%)

- Banking apps (+3%)

- Crypto apps also saw a resurgence, surpassing 2021 levels. Leading players include Binance and Tonkeeper.

For a more detailed analysis of the mobile financial apps market, check out this article.

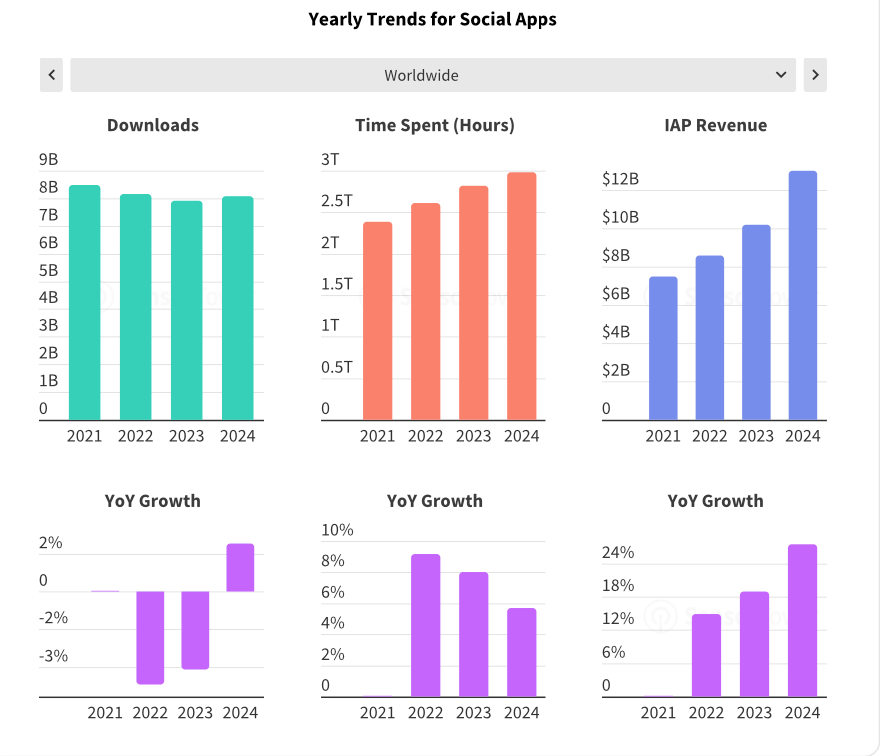

Mobile Users Spent 3 Trillion Hours on Social Media

In 2024, iOS and Android users spent 3 trillion hours on social media — a 6% increase from 2023. The rise in engagement intensifies competition among platforms, pushing them to find new ways to monetize.

One key trend is the expansion of revenue models. The success of TikTok with in-app purchases (IAP) has prompted other social networks to integrate additional revenue streams.

Advertising approaches are also changing. Apps are increasingly targeting specific platform audiences.

For example, sports services are promoted on X and LinkedIn, platforms where men dominate. However, food services are also using these platforms, even though their target audience is predominantly women.

This demonstrates that flexible targeting helps expand reach and attract new users.

We also advise clients not to limit themselves to niche platforms for in-app placements. While focusing on specialized apps is important, it’s also crucial not to overlook popular segments.

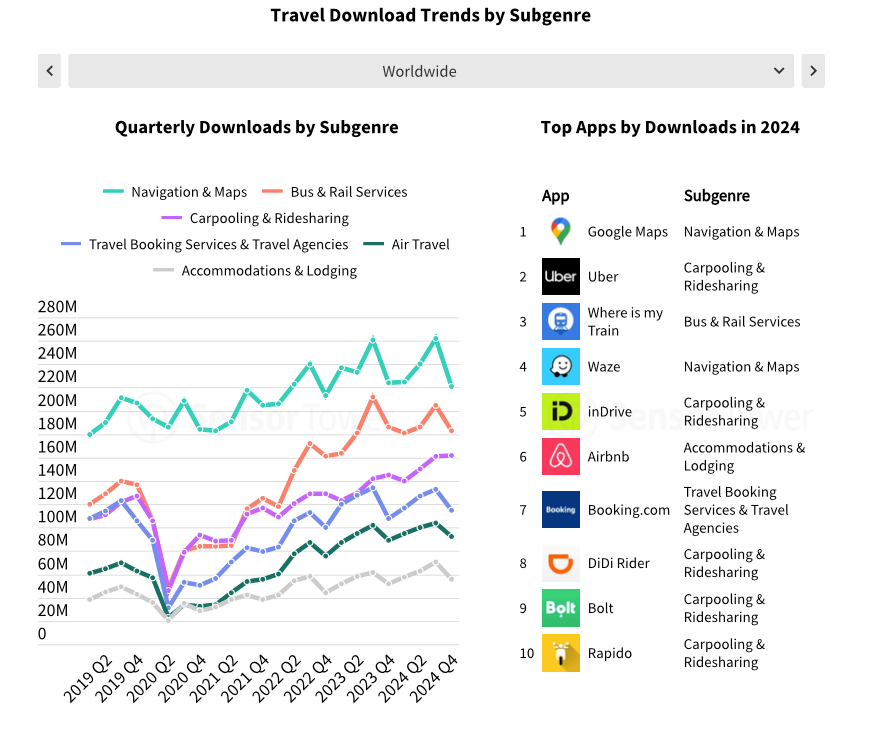

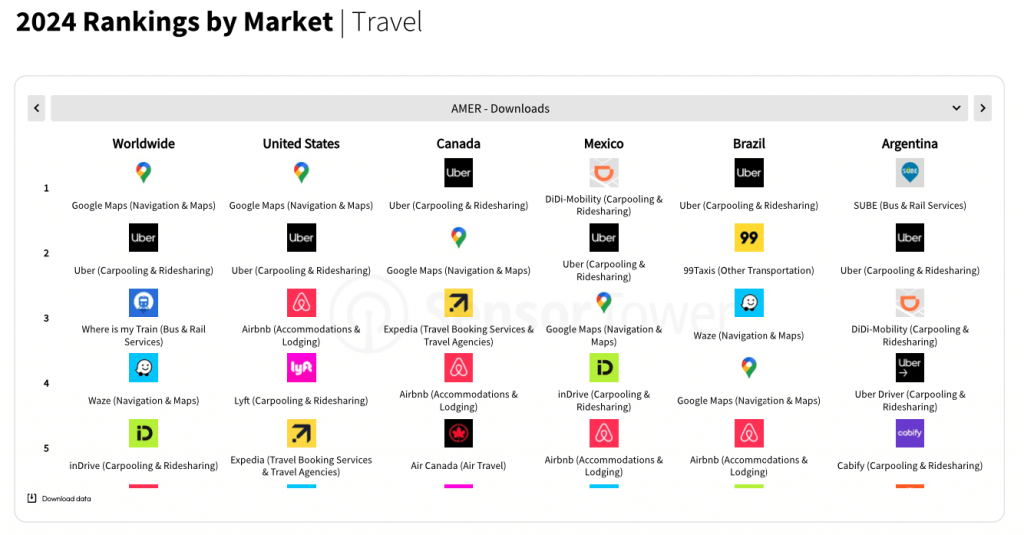

Growth of Travel App Downloads Slows Down

In 2024, travel apps were downloaded 4.2 billion times, a 3% increase from the previous year. According to Sensor Tower, this growth is linked to the recovery of tourism but remains moderate due to high travel costs.

Seasonality plays a key role for travel apps. Downloads spike sharply during the summer, making this period especially important for travel companies.

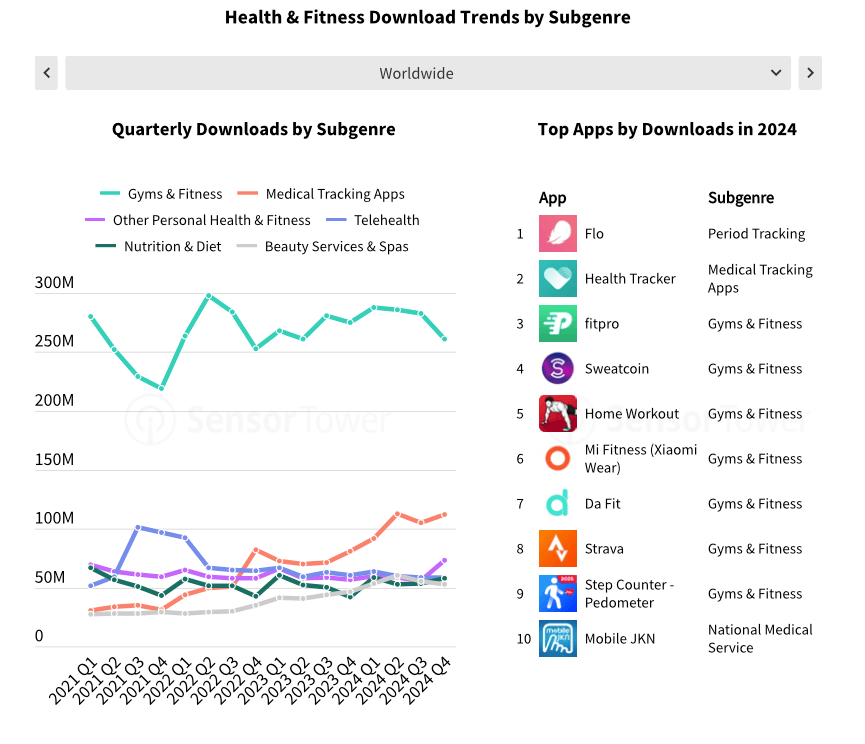

Growth of Revenue in Health & Fitness

According to State of Mobile 2025, fitness tracking apps have become the most popular category by downloads. This is attributed to the growing interest in a healthy lifestyle.

The data confirms this: 7 out of the 10 most downloaded apps worldwide belong to the Gyms & Fitness category.

Services with reward systems, such as Sweatcoin, CashWalk, and WeWard, are especially popular. They motivate users to stay active by converting steps into rewards.

By the way, our platform can display ads in these top health, fitness, and sports apps, including:

- Flo

- Health Tracker

- Fitpro

- Home Workout

- Step Counter – Pedometer

We’ve already shared tips on how to advertise in apps focused on men’s and women’s health in our blog.

According to State of Mobile 2025, mobile apps have become an integral part of users’ daily lives and an excellent platform for advertisers.

At BYYD, we understand this, which is why for 10 years we’ve been helping brands achieve their goals through in-app advertising.

Check out our case studies and get in touch with us to find the best solution for your business.

Found this helpful? Share it with your friends and colleagues!

For consultations and partnership inquiries:

- Submit a request on our website

- Email us at hello@byyd.me